1. Introduction

The titles of the double taxation agreements (DTAs) of the first batch of selected jurisdictions covered in this note reveal six distinct objectives. These comprise:

(a) the elimination or avoidance of double taxation;

(b) the prevention of tax fraud, evasion or avoidance;

(c) the encouragement of trade and investment;

(d) the exchange of information;

(e) reciprocal administrative assistance; and

(f) the settlement or regulation of other tax matters.

This note reviews the extent to which these objectives are reflected in the agreements concluded by the selected jurisdictions. The first two objectives are covered under separate headings and the remaining objectives are covered under a single heading.

2. The Elimination or Avoidance of Double Taxation

Virtually all of the agreements concluded by most of the selected jurisdictions contain wording that mentions the objective of the elimination or avoidance of double taxation (Figure 1). The notable exception is a segment of the agreements of the United States that were almost entirely concluded in the 1970s. These mostly comprise the 1973 agreements with the former Soviet Republics of Armenia, Azerbaijan, Belarus, Georgia, Kyrgyzstan, Moldova, Tajikistan, Turkmenistan and Uzbekistan.

Figure 1. References to the Elimination or Avoidance of Double Taxation in the Titles of Double Taxation Agreements

3. The Prevention of Tax Fraud, Evasion or Avoidance

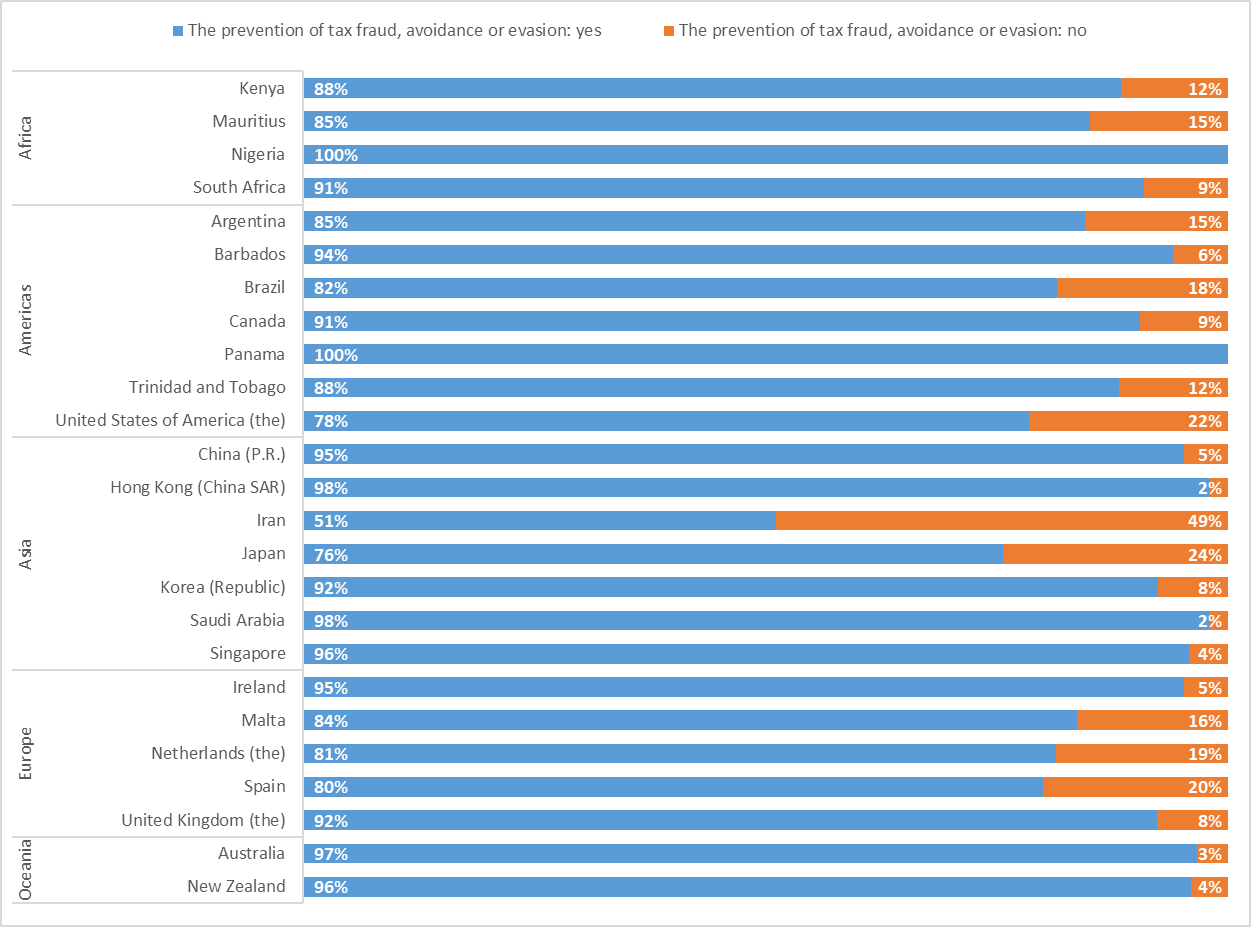

In contrast to the focus on the elimination or avoidance of double taxation, references in treaty titles to the prevention of tax fraud, evasion and avoidance are not nearly as common (Figure 2).

Figure 2. References to the Prevention of Tax Fraud, Evasion or Avoidance in the Titles of Double Taxation Agreements

A few of the jurisdictions have made changes to the titles of some of their agreements following their entry into force. However, in only a limited number of treaties (e.g. the Austria – New Zealand DTA (2006) and the Netherlands – Switzerland DTA (2010)) do such changes involve the addition of an explicit reference to the objective of preventing tax fraud, avoidance or evasion.